State of the Snowsports Market – Part II: Inspiration, information and trust

5th December 2018

Category : News

LISTEX regularly polls a representative sample of snowsports consumer to gather their views on all aspects of researching and purchasing snowsports products including holidays, equipment and other services.

The report specifically compares and contrasts responses from the under 35 demographic versus the whole market, to gain some insight into how the market may evolve over the next decade.

The LISTEX 2018 ‘State of the Snowsports Market – UK’ report draws on consumer survey data (gathered in conjunction with online retailer Sport Pursuit) and an industry survey completed by attendees of the LISTEX Summer and Winter Exchanges 2018.

Sources of information and inspiration when looking for ski holidays

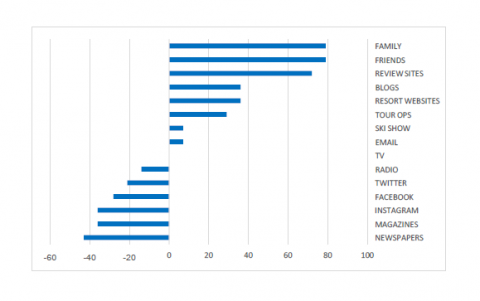

Respondents were asked what source of information and inspiration they used when looking for ski holidays, and then to rate how much they agreed or disagreed with those sources being important to them in the research process. A score was calculated by taking the total number of disagreed scores from agreed scores, and then ranked as below.

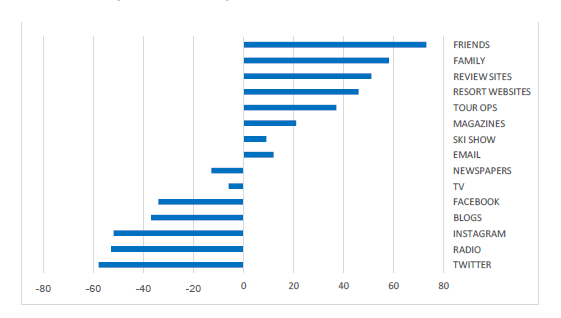

Whole market – sources of information and inspiration

Similarly, to previous surveys the highest scoring sources were friends and family, but new for 2018 review sites scored very highly coming in third. Tour operators also a new choice for 2018 scored in the top 5, as did resort websites.

Social media channels all scored negatively, with Twitter and Instagram scoring very badly with the overall market, and radio also scored poorly.

Email and newspapers were only separated by one place, though email scored significantly better.

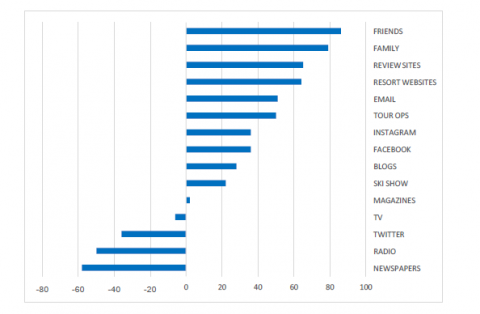

Under 35’s – sources of information and inspiration when looking for ski holidays

The same question filtered by responses from the under 35’s had no impact on the top 4 results, though tour operators dropped to 6th and email jumped to 5th. Instagram and Facebook scored significantly better than for the whole market, but Twitter remained firmly in negative territory.

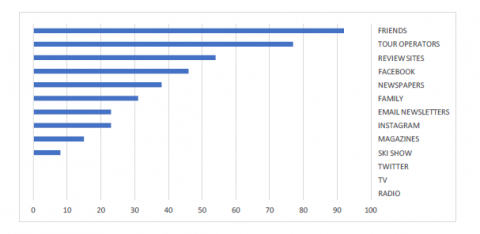

We asked the snowsports industry to choose the top 5 sources of information and inspiration for consumers when researching a holiday. The responses are shown below

Industry view – perceived top sources of information and inspiration

It’s interesting to note the perception in the industry that Facebook and newspapers are considered as more significant sources of inspiration and information to skiers than those consumers themselves revealed in the consumer survey.

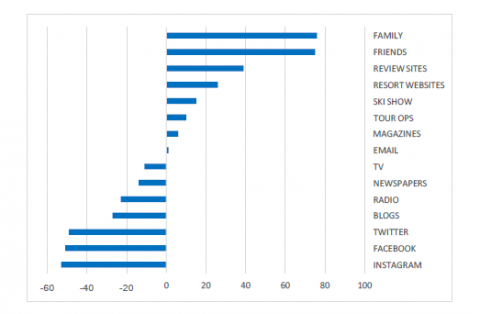

Whole market – trust in sources of information and inspiration when looking for ski holidays

As would be expected friends and family top the chart, with the key social media channels rooted to the bottom. Resort websites performed, suggesting consumers see them as a more balanced source of information than tour operators.

Looking at the data again just for the under 35’s changes some of the picture, notably blogs jump considerably higher to be the 4th most trusted source, whilst newspapers replace social media at the bottom of the table. However, whilst social media is more trusted overall by this demographic, it still rates negatively overall. Tour ops close the gap on resorts, friends and family remain top.

Under 35’s – trust in sources of information and inspiration when looking for ski holidays

Do you know the difference between an organic listing and an ad?

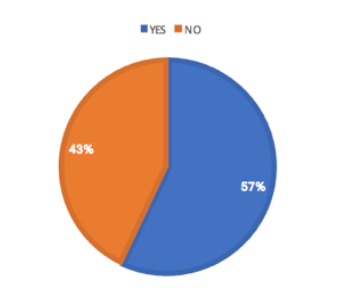

We were interested to know the level of awareness in the market of the difference between search results adverts and organic results, in the light of recent changes by Google to remove sidebar ads and display both ads and organic results in the main page format

Whole market – do you know the difference between an organic listing and an ad?

It was surprising to us that over 40% of respondents don’t know the difference between an ad and an organic listing, though this changes when we consider the under 35’s.

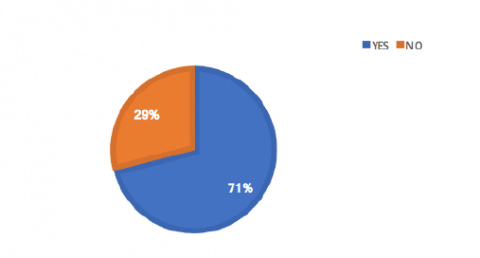

Under 35’s – do you know the difference between an organic listing and an ad?

What are the most important factors when choosing a ski holiday destination?

This question has been asked in every market research we’ve conducted to date, and the results are remarkably consistent year on year.

Price remains the number one factor for skiers when choosing their holiday, and this is confirmed by other recent surveys. Resort altitude and size of ski area are also consistently in the top 5 year on year, it seems snowmaking has not yet convinced a majority of the market to be a completely viable alternative to the snow ‘security’ offered by high altitude skiing.

Quality of accommodation and food have both climbed to higher importance this year, highlighting the fact (endorsed in the comments provided by those completing the research) that whilst price is the most important factor skiers aren’t looking for the absolute lowest price, they are selecting based on their important factors of altitude, ski area, accommodation and food quality – and then selecting the best value options that meet those criteria, hence resorts which may be considered expensive, but meet all of those quality factors, are still immensely popular.

The future ‘winners’ from an industry perspective are therefore those who can satisfy consumer demand for their most important factors, at the best price.

Also of note is that tour operators remain low scoring as an important factor, yet as we saw earlier are an important source of information and inspiration in the holiday research process. So, whilst tour operators are engaging consumers and providing valuable content early on, there is an opportunity to drive a stronger relationship with those consumers following the research stage to become a more important factor at the point of booking.